Reason[5]: Bitcoin has No Intrinsic Value Fiat so-called currencies such as USD and Bitcoins have ZERO Intrinsic value, which means that...

Reason[5]: Bitcoin has No Intrinsic Value

Fiat so-called currencies such as USD and Bitcoins have ZERO Intrinsic value, which means that you can not use them for anything else except as a so-called partial medium of exchange. You can't eat paper or bitcoins, you can't make tools using them, you can't use them for any industrial purpose unlike Gold or Silver. In their true, original, physical or virtual form all fiat currencies have no inherent value except the speculative trust build in the eyes of the beholders.

Bitcoin enthusiasts argue that, since millions of dollars are invested to mine bitcoins using expensive computer hardware and electric power. Therefore according to them, every bitcoin created actually has a lot of worth.

If we accept this logic, then it would mean that bitcoin itself has no inherent value. The actual value of it resides inside the electric energy that is used to mine bitcoins. So without that electric power, bitcoin becomes useless.

You know why? Because Gold doesn’t depend on anything, its value can’t be manipulated or artificially implanted. It has tangible value not a perceived value and is the only thing that can help you in times of need.

Just because something is used as a medium of exchange does not give it the intrinsic value. This is beautifully explained by Warren Buffet in an interview to CNBC's Squawk Box:

“Bitcoin is a method of transmitting money. It's a very effective way of transmitting money and you can do it anonymously and all that. A check is a way of transmitting money, too. Are checks worth a whole lot of money just because they can transmit money? Are money orders? You can transmit money by money orders. People do it.

I hope bitcoin becomes a better way of doing it, but you can replicate it a bunch of different ways and it will be. The idea that it has some huge intrinsic value is just a joke in my view.”

— Warren Buffet [Source]

Reason[6]: Bitcoin is not a ‘Store Of Value’

A store of value is any form of wealth that maintains its value without depreciating over a long period of time. Commodities such as gold and silver are good stores of value, as their shelf lives are ever lasting.

Since Bitcoin’s price is simply based on pricing-off the USD, a rise and fall in fiat dollar puts an exact similar ripple effect in the Bitcoin’s price. Both bitcoin and USD are fiat, backed by nothing but market speculation.

A bitcoin worth $5,000 today, could be worth $4,000 or less after a week due to its abnormal rate of volatility. A Bitcoin can loose 40% of its value within a week. Bitcoin prices recently dropped from a high of $19,891 on the 17th of Dec to test a local floor of $11,000 on 22nd Dec, 2017 - a straight 40% drop. Which is far worse than paper currencies where even two percent change in local exchange rate vs. US dollar, could simply crash stock exchanges and set the economy of the country on red alert.

The cryptocurrency’s value fell dramatically on Wednesday (20th Dec 2017), dropping by almost $2,000 in just an hour at one point. It has been up and down constantly ever since, and dipped below the $13,000 (from $19.2K) mark earlier this morning.

Bitcoin is notoriously volatile, and its value is expected to continue to shift wildly.

Those fluctuations have caused problems with actually using bitcoin, with Steam recently announcing that it won’t be able to take it any more and multiple exchanges saying the huge amounts of trading is leading to problems with actually transferring them. — Independent News

Volatility of Bitcoin Vs. Gold

| Volatility Index | GOLD | BITCOIN |

|---|---|---|

| Last 30 days | < 0.6 % | < 6.0 % |

The fluctuating line (Bitcoin) when compared to the almost constant line (Gold) in the chart above is enough a proof of how volatile bitcoin is.

Bitcoin is undoubtedly the most volatile currency ever introduced that is hardly a store of value and whose foundation can shake with slightest media speculation as happened recently when JP Morgan CEO called “Bitcoin is a Fraud” and China banned all Bitcoin exchanges.

Reason[7]: Bitcoin is not a ‘Unit Of Account’

A unit of account must have a stable value i.e. should be nonvolatile. It should be a reliable and non-fluctuating unit of measure to judge the value of things.

When you buy something from a grocery store or shopping mall, you see price tags mentioned on each item. This would have been impossible if paper currencies were as volatile as bitcoin today. Bitcoin value fluctuates with a volatility rate of 6% as we discussed earlier. It is so speculative in nature that it can loose 30% of its value within a week. Anyone who will sell items online or offline with bitcoins will either suffer a 6% loss or gain on each merchandise.

If an item in a bitcoin-accepting store costs $100 during morning, it could cost $95 during evening or $105 during night or $70 the next day! You can never have a fixed price with bitcoin. I am not sure if any sensible retailor would take such a risk.

Online retailers that quote in Bitcoin usually update at very high frequency so as to maintain stable prices in traditional currencies such as US dollars.

This truth is well explained by a sensible bitcoin user himself who loves the blockchain technology but is not blinded by the lies of Bitcoin pundits. The Gulden lead developer, Malcolm MacLeod, who when asked by Cointelegraph if bitcoin is actually used as a currency in the marketplace, he replied:

"I don't think so, I tried to buy something with Bitcoin yesterday (June, 2017) on a popular retail site and the transaction timed out twice. I have a hard time believing anyone is using it for anything other than trading and speculation right now."

— Gulden lead developer, Malcolm MacLeod

Reason[8]: Bitcoin Is a Speculation not Currency or Investment

Speculation is the purchase of an asset with a hope or guesswork or prediction that it will become valuable at a future date. It is also the practice of engaging in risky financial transactions in an attempt to profit from short term fluctuations.

The focus of bitcoin buyer and seller is not as much in support of blockchain technology or on the usability of bitcoins as much as it is in its price movements. They are all in a gold rush and busy buying in bitcoins because of a ‘fear of missing out’.

Celebrities and main stream media is used immensely today to create a sense of trust and credibility in bitcoin market (details here). Following are some magical statements that are used to hypnotize new adopters of bitcoin:

- “Buy it today else you will regret tomorrow”

- “If you had bought bitcoins one year ago, you would have become a millionaire today”

- “You will be a stupid, if you don’t buy bitcoin today”

- “Buy bitcoin today and thank me after a year”

- “Buy Bitcoin, its the currency of the future!”

- “Buy bitcoin today and forget about it for next 2 years!”

How can one survive such tempting statements when they come directly from celebrities and politicians on the pay-roll of this elite mafia. Such dangerous game of speculation is the major reason behind the extremely over-priced value of bitcoin today. People are buying it blindly because someone they worship as role models told them to do so!

Here comes the testimony of one sensible bitcoin user and Gulden lead developer, Malcolm MacLeod, who has finally admitted that the current Bitcoin price rally is not real growth (actual network expansion) but merely due to speculation and that eventually it will burst.

MacLeod said to Cointelegraph on June, 2017:

"I think we are way up into speculative territory on not only Bitcoin but a bunch of other altcoins, all of which have gone up quite ridiculously."

He argued that how can the price of bitcoin increase so dramatically when in fact there is no solid proof of Bitcoin network expansion or evidence that more people are getting involved and using it for everyday purchases at the marketplace.

When asked if more people are actually using bitcoin as currency, he said:

"I don't think so, I tried to buy something with Bitcoin yesterday on a popular retail site and the transaction timed out twice. I have a hard time believing anyone is using it for anything other than trading and speculation right now."

He called the current over-valued price of bitcoin as a bubble:

"Ultimately, I think we are in a bubble and at some point, it is going to have to come to an end, but in the meantime, it could easily go up again before that. When things are based on pure speculation like this it is anyone's guess: we could easily see $3000 or even $4000, but we could just as easily see the price tumble back down to $1000. I think anyone who pretends there is certainty in either direction is being dishonest."

Horrible will be the day when this Gold rush finally ends.

According to Warren Buffett (American business magnate), buying bitcoin is not invesment but mere speculation that is no different than gambling where you buy something just hoping that the next person will pay you more for your worthless bits.

In an interview given to Yahoo Finance on 28th April, 2018, Warren Buffet said categorically that Bitcoin is nothing more than a gamble and speculation:

“There’s two kinds of items that people buy and think they’re investing, One really is investing and the other isn’t.”

Bitcoin, Buffett says, isn’t.

“If you buy something like a farm, an apartment house, or an interest in a business… You can do that on a private basis… And it’s a perfectly satisfactory investment. You look at the investment itself to deliver the return to you. Now, if you buy something like bitcoin or some cryptocurrency, you don’t really have anything that has produced anything. You’re just hoping the next guy pays more.”

When you buy cryptocurrency, Buffett continues, “You aren’t investing when you do that. You’re speculating. There’s nothing wrong with it. If you wanna gamble somebody else will come along and pay more money tomorrow, that’s one kind of game. That is not investing.”

— Warren Buffet

Based on this crystal clear distinction made by Buffet, its quite clear that the entire cryptocurrency market is nothing more than just one high stakes gamble that can go either way.

Reason[9]: Bitcoin Is Not Tangible

People who understand the concept of wealth or money believe in the wise saying:

“You don't own it if you cant hold it”

Bitcoin is a virtual currency and it has no existence in real or physical form because it is backed by nothing, not even the bogus faith in some government. You can’t touch it nor can you see it. In other words, during financial crisis or war crisis, bitcoin is useless without internet or electric power.

What else could have the elite dreamt of than a monetary system through which they could track minute-to-minute activity of every single person. You will not be able to hide your wealth from cruel government taxes in future.

Can you choose to live in such a cashless economy where your liberty and privacy will be dictated by electronic scripts backed by nothing?

Reason[10]: Bitcoin Is Useless Without Electricity and Internet

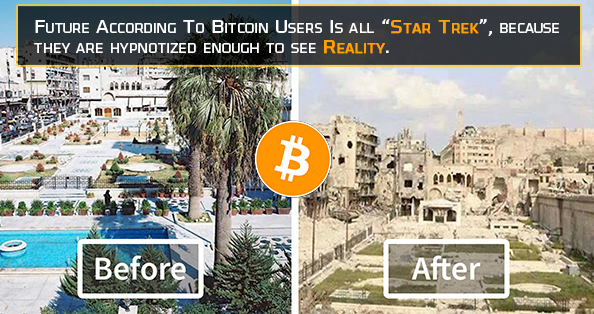

The greatest misconception that bitcoin users have is that they see the future the way its depicted in hollywood movies like Star Trek or Star Wars with flying jets instead of cars, space suits instead of cloths and mutants instead of humans. For them the future is all electronics, ever lasting alternative sources of energy, no power loss and no wars..

This is exactly what the people of Afghanistan, Iraq, Syria, North Africa and Libya might have dreamt too...

The way precious natural resources are wasted in air to mine cryptocurrencies today is alaraming. For a second consider the entire world being cashless. People trading with one another using cryptocurrencies.

- How do you feel during Christmas, Eid or Diwali when you all rush to ATMs in order to cash out funds and you find that the ATM service is currently not available?

- How do you feel when you have to suffer through hours of load shedding due to shortage of power supply during summers?

- How do you feel when a retailor tells you “Sorry sir we can’t accept credit cards as we just lost internet access..”

I am sure it pisses you but at least somehow you will manage thanks to some cash savings at home but how will you manage if all you had was cryptocurrencies? How will you shop basic necessacities of life in absence of electricity and internet?

If sweden is hit by an earthquake and all its power houses get collapsed, how will the citizens buy goods and services in such condition provided that sweden is almost cashless?

Lets ignore worst case scenarios like wars or natural disastors and instead discuss what is more possible and happens every year around the world i.e. Power Blackout.

Be that the power outage in the following countries which effected millions of people:

- 2012 India blackout, 620 million effected

- 2015 Pakistan blackout, 140 million

- 2014 Bangladesh blackout, 150 million

- 2015 Turkey blackout, 70 million

- 2003 Northeast blackout in USA and Canada, 55 million

- the list goes on.....

Imagine all these countries becoming 100% cashless, what would you see on the streets during a blackout when millions of people won’t be able to buy or sell food and medicines in exchange for a cryptocurrency? Nothing big according to crypto-worshippers but violence, bloodshed and chaos..

A digital currency does only make sense if it is backed by gold reserves which are regularly audited under strict governement regulation and the public having open access to the aduit reports.

In such case even if entire currency is hacked or internet goes off, the public will not go bankrupt as they will still have access to the physical gold which they can claim anytime using their digital IDs whose backup will still exist on several government servers online or offline.

COMMENTS